A week and a half ago, only marginal attention was given to emerging reports of pneumonia in Wuhan. The signing of the Phase One trade deal and the future of China-US relations continued to be at the forefront of China’s national attention, and if a major domestic controversy existed, it was over how two women were able to drive a luxury SUV into the Forbidden Palace to snap pictures for social media. Discussions in homes and offices primarily revolved around that and each person’s plans for the Spring Festival. The Year of the Rat was approaching – and as the first animal in the Chinese zodiac, it represents a new cycle and a new beginning.

Things have changed since then.

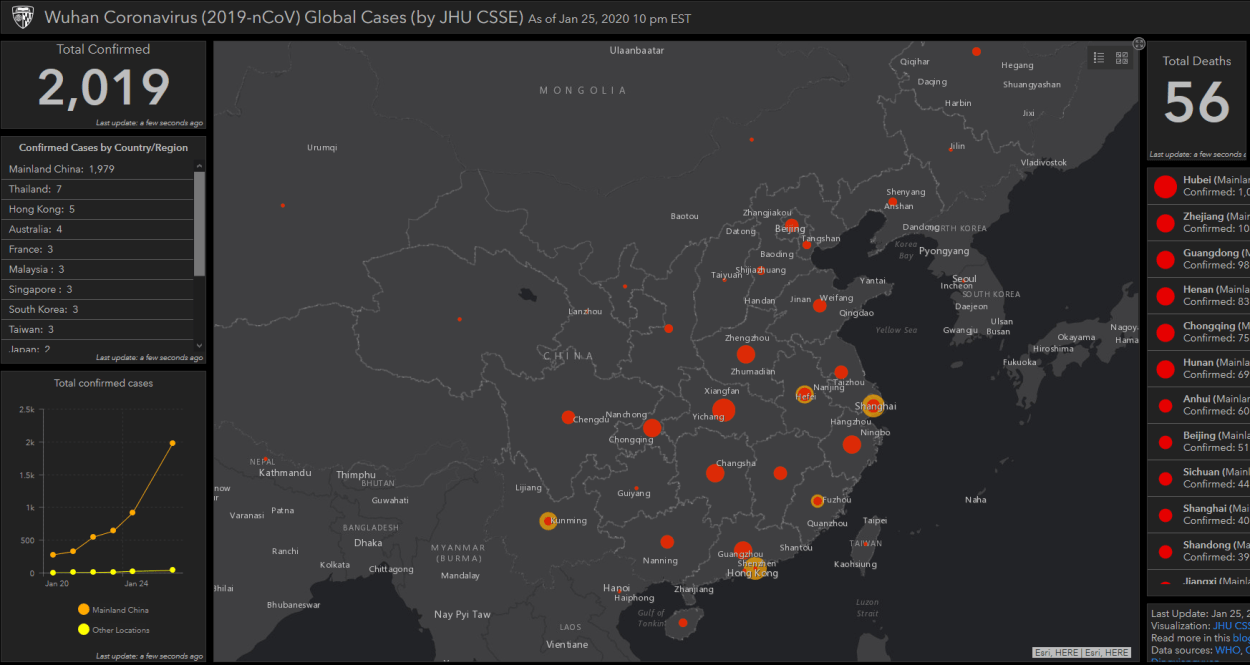

As of Sunday, January 26, there have been 56 fatalities directly attributable to the ongoing coronavirus outbreak. The number of confirmed cases worldwide stands at 2,054, but the numbers from the National Health Commission are unlikely to be indicative of the true value – due to either practical circumstances or ‘political considerations’. As such, it is difficult to precisely assess and confirm the scale of the outbreak from a global perspective, but there are growing signs that this is now a fully-fledged domestic crisis – a calamity that is pushing the capabilities of the Party and state. The entirety of Hubei province (~60 million people) is now under virtual lockdown, and other regions are said to be ruminating over similar measures.

If the situation continues to escalate, it is highly probable that China’s economic, political and social development will witness pronounced effects.

The clearest gaugeable consequence will be the severe damage caused to first quarter economic growth, in turn dramatically muddling the hopes of 2020 acting as a period of recovery. China’s increasingly consumption-based economy is tremendously dependent on Chinese New Year for meeting targets and expectations, and for many industries, the outbreak brings unwelcome pain after an already tumultuous year. The film industry, as an example, saw uncertainty swell up in 2019, and as such, 2020’s spring releases were not just a chance to reap greater revenue – they were critical to the continuation of any forward momentum. Many premieres have been cancelled, and nearly every theater has been shut down. Even if they were not, it would have been unlikely for them to receive any sizeable audience.

This is a story that many businesses and industries will face, in turn inflicting larger shockwaves at a critical juncture where the economy is seeking to transform into a ‘high-quality’ services and consumption-based model of growth. While this transformation can be expected to continue and fully mature, economic lethargy in 2020 will slow this process down. In some respects, this also applies to other macroeconomic trends. China’s long-term growth should largely remain the same, but if 2020 truly proves to be weaker amidst a dismal start, certain projections and benchmarks could be pushed back by at least a year. A whole array of preexisting calculations would then have to be adjusted, none of which would be beneficial for the Party.

Even in the ongoing whirlwind of outbreak response efforts, the central leadership must know that longer-term ramifications – far-reaching in breadth and severity – will have to be taken into account. On top of preexisting external pressures, it is becoming clear that guiding the country through this new zodiac cycle will be even more difficult than expected.

Updates to this will likely come in the following days.

Sources and Further Reading:

Image Source + Updated Map and Values

China and the world: Inside a changing economic relationship – McKinsey

The economic importance of China’s Lunar New Year – South China Morning Post

How the Wuhan coronavirus infected the Chinese film industry – Variety

China closes cinemas, delays film premieres over coronavirus spread – CBC